Jennifer A. Taylor

Sandoval County Treasurer

(505) 867-7581

treasurers@sandovalcountynm.gov

2nd Term, Re-Elected November 2024

Term January 2025 - December 2028

Next Election for this seat is November 2028

TREASURER'S OFFICE LOCATION

1500 Idalia Road, Building D

Bernalillo, NM 87004

We are located on the first floor

treasurers@sandovalcountynm.gov

Phone: 505-867-7581

Toll Free: 1-800-332-8022

Fax: 505-771-8684

Hours of Operation:

Monday - Friday 8:00am - 5:00pm

During Tax Season, appointments before 8:00 a.m. and after 5:00 p.m. are available upon request by calling 505-867-7579

Closed for Staff Meetings:

The office will be closed from 2:30-3:30 p.m. on the second Wednesday of each month for a staff meeting. Payments may be dropped off in the box between windows 2 and 3 and a receipt will be mailed to you.

METHODS TO PAY for PLAT MAPS & TAX RELEASES

In the United States and Canada, Certified Funds are a form of payment that is guaranteed to clear or settle by the company certifying the funds.

When making certain types of transactions, such as purchasing real property, motor vehicles and other items that require title/ownership, the seller usually requires a guarantee that the payment method used will satisfy the obligations. To do this, the seller will require certified funds, usually in the form of:

- Certified check

- Cashier's check (known as a bank draft in Canada)

- Money order (usually with proper identification)

- Manager's check (usually with proper identification)

- EBT wire transfer (i.e. Western Union)

Specifically, personal/business checks are not allowed, as the account may not have sufficient funds, and credit cards are not allowed, as the transaction may later be disputed or reversed.

Please note that appointments are required for Tax Releases.

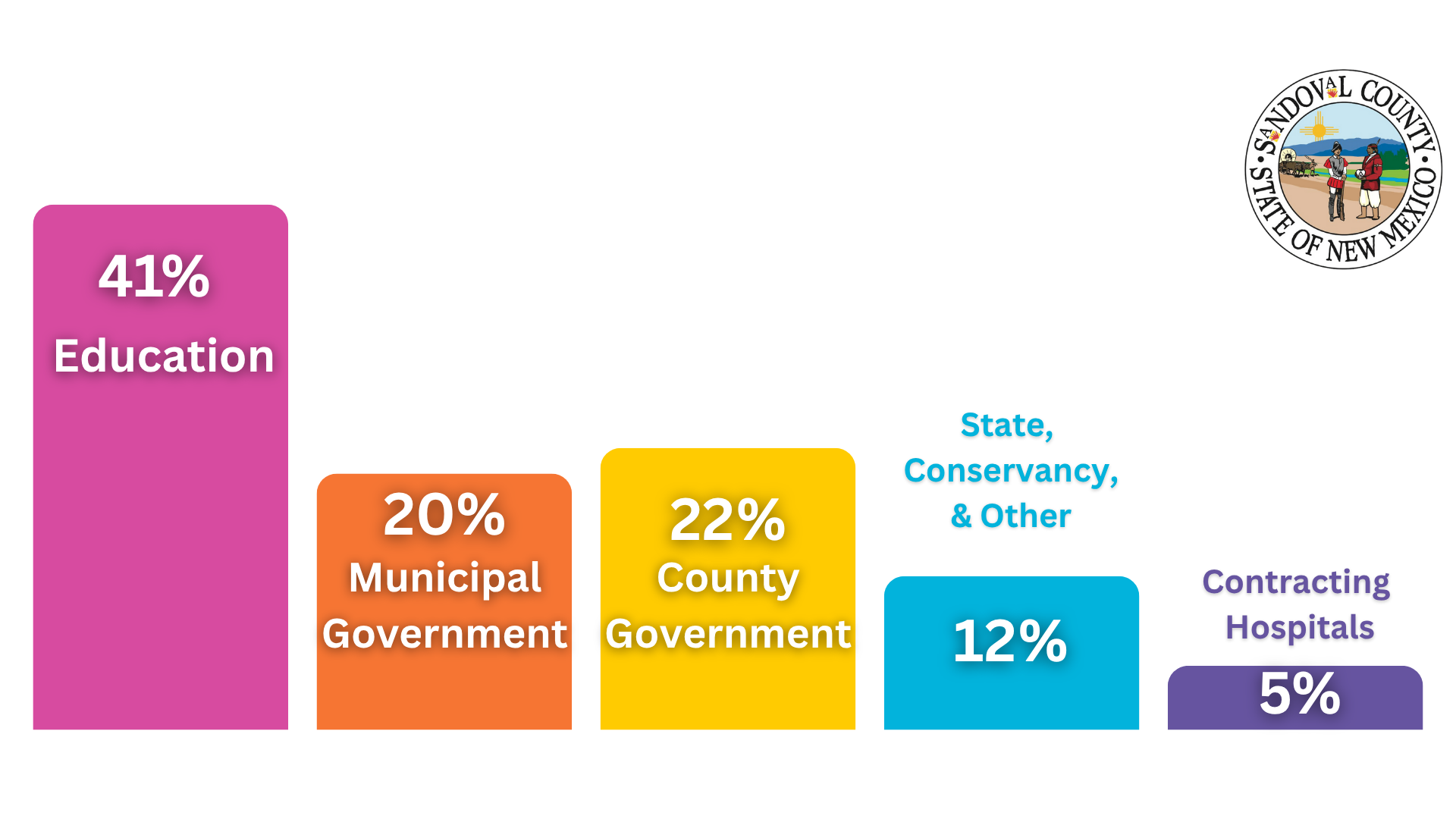

What Do My Tax Dollars Pay For?

REFLECTIVE TAX YEAR 2024

What We Do

PROTECT: The Treasurer's Office accounts for and protects $59.4 million in non-property tax revenue, $194.5 million in property tax revenue and $61 million in investments.

COLLECT: The 10-year collection rate is 99.17% on over $1.411 billion that the Treasurer is charged to collect. The 2024 Tax Roll comprised $194.5 million of that total.

INVEST: Safety is our priority when it comes to your investments; then Liquidity; and then Yield. Your investments are in compliance with state statute and the Sandoval County Investment Policy.

DISTRIBUTE: Thank you for making your property tax payment. Your tax dollars are distributed to support the following county programs:

• DWI • Fire & 911 Services • HCAP • Libraries • Public Safety • Senior Programs • Roads & Infrastructure • Landfill • Detention Center

We also distribute your tax dollars on a monthly basis to:

• Schools & Libraries • Municipalities • Water Conservancy • State of New Mexico • Special Districts

REPORT: Required to file and distribute the Treasurer’s Report on a monthly basis. This report verifies all monies that flow through Sandoval County.

We utilize our records to complete the annual audit in collaboration with administration. The Treasurer’s Office has had a clean audit for the past four years.

How We Serve You

The Treasurer's Office serves the residents of Sandoval County in many ways and always works to provide the highest quality customers service. We're here to assist you in the following ways:

- Answer your property tax questions

- Offer a Statement of Taxes Due or a copy of your tax bill

- Provide outreach at community libraries throughout the county

- Offer services in English and Spanish

- Accept and receive tax payments by cash, check, money order, debit card or credit card (convenience fee applies to debit and credit card payments)

- PLEASE ALLOW 72 HOURS FOR PAYMENT TO BE POSTED

Meet Your Treasurer's Office Staff

Pay Your Property Taxes

Property taxes may be paid in person, by mail, through mortgage companies, at a drop box located in the North parking lot of the County Administration Building, New Mexico Bank & Trust Branches in Rio Rancho (accepted during 1st half property tax season November 10th- December 10th ) and online or over the phone. The Treasurer’s Office staff, as well as the phone service, are accessible in English and Spanish. (View Drop-Box location)

Important Dates

The Sandoval County Treasurer's Office works on a tax calendar instead of a standard yearly calendar. Here are some important dates to remember:

- November 1: Tax bills are mailed

- November 10 through December 10: First-half taxes are due

- April 10 through May 10: Second-half taxes are due

*Appointments before 8:00 a.m. or after 5:00 p.m. are available upon request during tax season. Please call 505-867-7581 to make an appointment.